The Indian stock market has changed over the years, especially in the area of technology. Gone are the days when stock brokers would gather at the stock exchange and shout out the buying and selling orders.

Investors and traders were at the mercy of stock brokers who had to deal with physical shares that they could keep with themselves or settle at the exchange. The trading process was slow and cumbersome, with settlement days being more than 10 days. Plus, there were 21 regional stock exchanges in the country with little regulation and multiple scams, which marred the whole stock market experience. Technology was limited and after the popular securities scam of 1992, it was pertinent to have reforms in place for better governance and sound regulations within the industry.

Advent of NSE

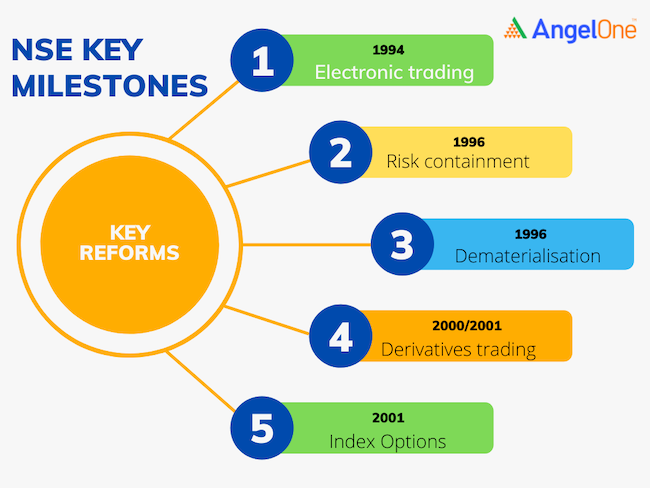

The pre-NSE days were chaotic and error-prone. When NSE was incorporated in 1992, it brought about much needed reforms. It was largely successful because of the changes that revolutionized securities trading in India and paved the way to a promising future.

Source: NSE India

Development of next gen online brokers

Next gen online brokers have complied with SEBI policies and made inroads in trading technology. The Indian citizen has been inundated with features such as, zero brokerage, biometric logins, charts, reports and widgets, and trading at high speed - all without the help of a middleman. Online brokers registered with NSDL and CDSL make sure to provide customers with a seamless experience, while keeping up with compliance, policies and regulations.

Smartphones paved the path for Gen X and Millennials

Technology has improved the way people communicate as well as trade. This is evident in the usage of smartphones in the country. The number of smartphone users in India was 750 million in 2021. With easy access to the Internet and the average time spent per day increasing every year, trading was brought to smartphones. The proliferation of Mobile apps gave way to stock brokers and finance houses to showcase their offering on a handheld, thereby securing the attention of Gen X, millennials and Gen Z. The benefits of tech in the broking houses are evident with so many investors downloading apps to place their trades.

Source: The Hindu

Use of Algorithm

As technology broke barriers, clients wanted a better experience with trading. This progressed onto online brokers helping their clients to trade using algorithms. Algorithmic trading (or algo-trading) uses a computer program that follows a defined set of instructions to place a trade. Algo trades are executed to avoid bias and reduce the possibility of mistakes as compared to humans. These trades follow disciplined trading strategies and eliminate errors attributed to psychological decisions.

Artificial Intelligence, Machine learning and robo advisory

Artificial Intelligence (AI) has taken over human intelligence in many ways than we can imagine. With the influx of AI, the decision-making capability has increased manifold as well as the number of predictions and forecasts using data analysis and machine learning techniques. AI has successfully kept away the biases of human emotion and has delivered results at the speed of thought. This change in the landscape has been adopted by broking houses to gain a competitive edge. AI also helps in creating customized advisory and a variety of customized services as they are better predicting models due to their vast and efficient systems. Angel One’s ARQ Prime* is one such example of AI.

Another technological breakthrough to keep in mind is Robo advisory. Robo advisors are digital platforms that provide automated, algorithm-driven financial planning services with little to no human supervision. A typical robo-advisor asks questions about a client’s financial situation and future goals through an online survey. It then uses the data to offer advice and automatically invest for the client. Robo advisory has been able to successfully recommend financial planning and stock market advisory to thousands of clients, while trending as a popular financial mechanism.

Source: Investopedia

Personal Finance is the new norm

With new age technology, financial institutions and broking houses are able to offer a bouquet of services to investors. These personalized services are mostly technologically-driven and have almost zero human interaction. Since personal finance and the stock market are closely related, many online brokers offer these services to their clients as an add-on service. A client is advised to monitor his/her finances through an app and then to invest/trade in the stock market, thus easing the process and gaining confidence among many who did not have access to this knowledge. Clients can track expenses, gauge market sentiments and book profits during favorable conditions, or invest into multiple products.

Faster settlement cycle

Investors are also helped by the ease and speed of settlement. Settlement cycle of securities is brought down to T+2 days (gearing towards T+1). The change from physical to digital has helped exchanges and investors equally. All this has brought transparency to the system and regulatory authorities have time and again issued guidelines to protect the interests of investors.

To conclude, the Indian stock market has come a long way in terms of technology and automation. SEBI has introduced many policies to make trading and investment easy and effective, while safeguarding the interests of the investors. The stock exchanges and allied financial institutions have not only implemented sound technological practices but have also helped clients achieve their goals through minimal yet effective processes. It will be interesting to monitor the upcoming advances in technology and the future of the Indian stock market in the years to come.

Disclaimer:

*ARQ is not an exchange approved product and any dispute related to this will not be dealt on the exchange platform.

Explore the Share Market Prices Today

| Tata Steel share price | Adani Power share price |

| PNB share price | Zomato share price |

| BEL share price | BHEL share price |

| Infosys share price | ITC share price |

| Jio Finance share price | LIC share price |

This blog is exclusively for educational purposes and does not provide any advice/tips on Investment or recommend buying and selling any stock.