We all know what listing of s is and how a company gets listed. However these days, we often come across news about companies delisting their shares too. But what is delisting? It means that the company is no longer willing to offer their shares for trading or investing in the Indian stock market. Let’s dig deeper into what is delisting of shares and what happens to the shares you own?

What do you mean by delisting?

When a company removes its shares from all the stock exchanges it was listed on is known as delisting of a company. Once the company is delisted, its shares won’t be available for buying and selling purposes for the public. A listed company can get itself delisted for a number of reasons like insufficient aggregate value of the company (based on the current share price and the number of outstanding stocks), bankruptcy, change in the company structure, etc. Read on to understand the types of delisting.

Types of delisting

Below are the types of delisting that happens in the Indian stock market.

1. Voluntary Delisting

As the name suggests, Voluntary Delisting is when the company decides to get itself delisted from all the stock exchanges.

2. Involuntary Delisting

When regulatory authorities compel a company to delist its shares it is known as Involuntary Delisting.

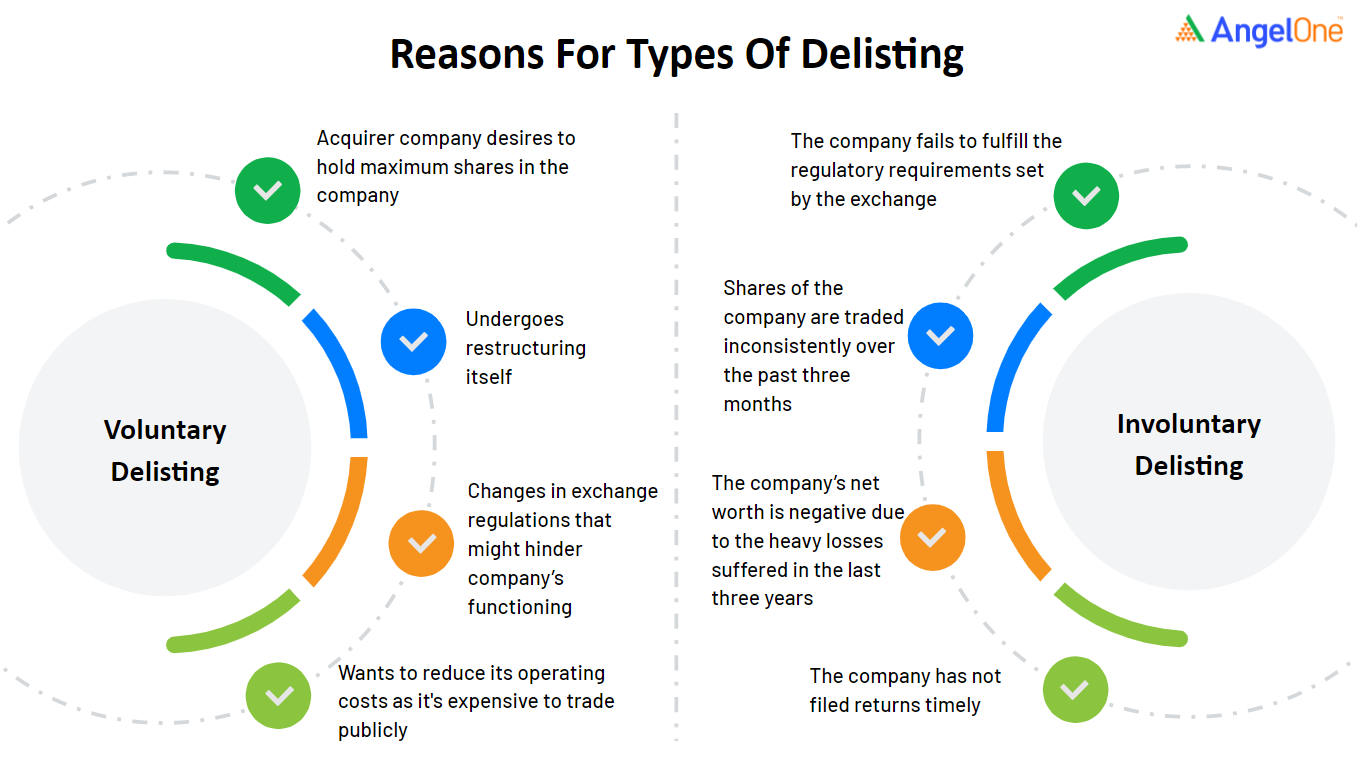

Let’s understand when the delisting is considered as voluntary or involuntary with the help of the below infographic.

What happens if you own shares of the delisted company?

If you own the shares after the company gets delisted, you are not allowed to sell the shares on NSE or BSE. However, you can sell the shares you own outside of the stock exchanges. Continue reading to know how you can sell your shares and get your money back in the two types of delisting mentioned above.

1. In the case of Voluntary Delisting

When you own a stock of a company that is voluntarily getting delisted, you have two options to sell your shares.

a. Reverse book building process

In this method, promoters of the company offer to buy back the shares by making a public announcement. They are required to send out the letter of offer to the eligible shareholders along with a bidding form. As a shareholder, you can sell your shares by applying for a buyback.

There are chances that the company offers buyback at a premium price when they opt for delisting due to expansion or merger. Being a shareholder, you can earn significant gain by opting for a buyback at a premium price. You should note that delisting of the company will be successful only when the shareholding of the promoters after buying back the shares from the public reaches 90% of the total share capital of the company.

b. Over-the-counter market

If you haven’t sold the shares through the reverse book building, you can hold them until you find a buyer on the over-the-counter market. However, you must know that it is difficult to sell the delisted shares as there will be very few interested buyers. Thus, you need a lot of patience to sell in over-the-counter markets as it may take a long time to find the buyer who is willing to buy the shares at your preferred price.

2. In the case of Involuntary Delisting

In this situation, promoters will have to buy back the shares at the value predetermined by an evaluator. In case of Involuntary Delisting, your ownership of the shares is not affected, however, the value of your shares might get devalued after delisting. Thus, traders or investors generally sell their shares when the company announces buyback.

Can delisted shares be listed again?

Shares can be relisted only if they fulfill the following guidelines laid down by the market regulator.

- Voluntarily delisted stocks

Such shares will have to wait for 5 years after their delisting date to relist.

2. Compulsorily delisted stocks

In this case, the delisted company will have to wait for 10 years before they relist themselves on the stock exchanges.

Conclusion

A company is said to be delisted when its shares are removed from the stock exchanges. Delisting of a company can either happen voluntarily or involuntarily. You must know that voluntary delisting doesn’t necessarily devalue your shares, but compulsory delisting might decrease the value of the shares. However, as a shareholder, you can still own them, apply for a buyback, or sell shares on the over-the-counter market. Decisions of selling or owning the shares after a careful analysis can prove fruitful and won’t hamper your investment goals.

Disclaimer: This blog is exclusively for educational purposes.