Introduction to FINNIFTY

In January 2021, the National Stock Exchange (NSE) launched Nifty Financial Services Index. FINNIFTY is the symbol for Nifty Financial Services Index in the stock market. It is an index that includes the stock values of various companies that are part of the Indian financial sector.

Although banks constitute well over 65% of the index, there are other major financial institutions in the list of component stocks as well. This includes insurance companies, housing finance, NBFCs and other companies that offer financial services.

FINNIFTY, in a way, tracks the performance of such companies or subsectors within the economy in one single index. Therefore, if the financial sector of India is doing well in terms of finances and investor confidence, then FINNIFTY will probably gain in value and vice versa.

Given this diversification, FINNIFTY is attractive as a benchmark for trading and investing.

Read on to learn more about the FINNIFTY index in detail, why you should invest and how to go about it.

FINNIFTY at a Glance

- The base date of the index is 1st January 2021.

- The base value of the index is 1000

- FINNIFTY tracks how various financial services in India perform. This includes banks, NBFCs, housing finance, insurance, etc.

- The index includes a maximum of 20 stocks. In order to be eligible for FINNIFTY, companies should be included in the Nifty 500.

- FINNIFTY is reconstituted on a semi-annual basis.

- In order to reduce turnover, a buffer is applied based on free-float market capitalisation, which also determines each stock’s weightage.

- The weight of each stock in the index depends on its free float capitalisation value in the market.

An easy way to understand free float market cap is:

Free-float market capitalisation = Shares outstanding x Price x Investible weight factors

(The more the number of investors’ shares listed as public, the higher the IWF. This number is determined based on the shareholding pattern reported by the company to any stock exchange.)

FINNIFTY Derivative Settlement Days

Derivatives on FINNIFTY are settled with cash on both weekly and monthly basis.

For monthly contracts, the expiry date is the last Tuesday of the month of expiry for a monthly contract.

For weekly contracts, the day of expiry is the Tuesday of the expiry week.

If the particular Tuesday is a holiday, then the previous trading day is the expiry date.

Note: The lot size for FINNIFTY futures and options is 40, and the number of maximum lots allowed per order for the same is 45.

FINNIFTY Stocks and Weightage

Several prominent and well-known stocks have been listed under FINNIFTY. HDFC bank holds the greatest weightage. Here is a table that shows the list of the top stocks in the index with their respective weights. Weightages keep on changing, basis the free float market capitalisation method.

| Name of the Company | Weightage in FINNIFTY (in %) |

| HDFC Bank Ltd. | 22.33 |

| ICICI Bank Ltd. | 14.89 |

| SBI Ltd. | 13.28 |

| Bajaj Finance Ltd. | 8.54 |

| Kotak Mahindra Bank Ltd. | 6.92 |

| Axis Bank Ltd. | 6.41 |

| Bajaj Finserv Ltd. | 5.19 |

| SBI Life Insurance Co. Ltd. | 2.42 |

| Power Finance Corp. | 2.58 |

| HDFC Life Insurance Co. Ltd. | 2.56 |

Other stocks in the index include those of Chola Investment and Finance Co., HDFC AMC, ICICI Lombard, ICICI Prudential, Muthoot Finance, Piramal Enterprises, Power Finance, REC, SBI Card, Shriram Finance.

However, the above numbers are as of 28th February 2023 and are subject to change over time.

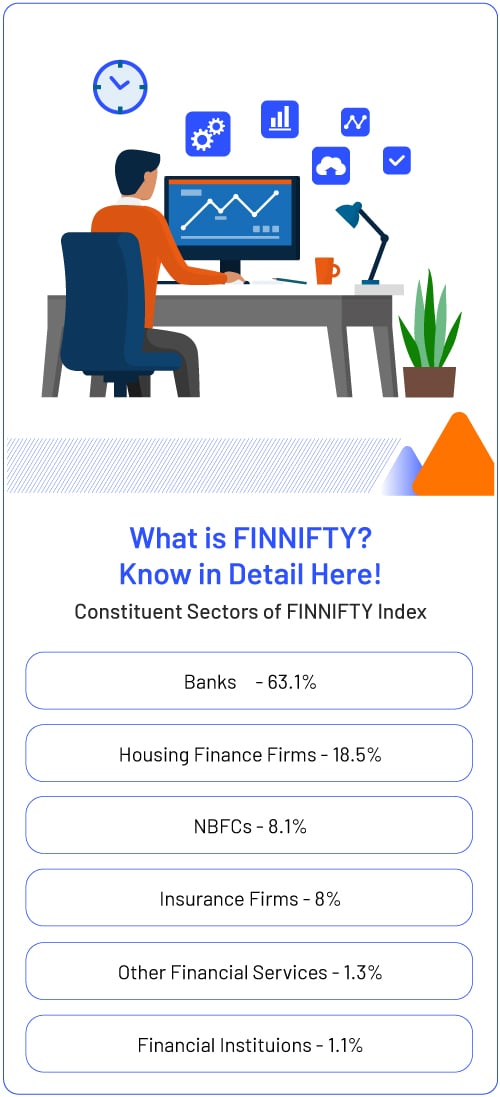

Sectors Involved In FINNIFTY

Banks represent the highest subsector within FINNIFTY at over 65% as of February 2023, with the top 3 banks (HDFC, ICICI and Kotak Mahindra) making up over 50% of the index.

Other subsectors represented include life insurance companies, some of which also have ties to the aforementioned banks (like SBI Life Insurance or HDFC Life Insurance companies). There are companies from other subsectors (like housing finance etc.) under the financial services sector, like Piramal Enter, Bajaj Finserv and Bajaj Finance.

How To Buy The FINNIFTY Index?

If you have a trading account with Angel One, you can search for FINNIFTY futures and options on the watchlist in order to trade in FINNIFTY derivatives. Remember to activate the FnO trading segment on your Angel One app before you start trading.

You cannot buy the index directly. However, you may invest via mutual funds that possess a weightage that is equal to and reflects FINNIFTY’s results.

In order to be able to purchase FINNIFTY as an index, you will have to buy the entirety of the 20 stock constitution in the correspondent weightage, as mentioned.

Why Should You Invest In FINNIFTY?

The following are the advantages of investing or trading in FINNIFTY -

- Diversification and risk reduction

The primary advantage of investing in FINNIFTY is how it aids in bringing down non-systematic risk. Non-systematic risks include financial and business risks. Issues such as declining revenues, strikes, rise in financing cost, narrowing profit margins, drop in sales etc., all count as non-systematic risks. These can easily be solved by making your portfolio diversified. By investing in a few different companies, you can spread out your risks. This is the crux of smart portfolio-building.

- Sectoral bet

If you are bullish about the finance sector as a whole and not just the banking sector, you now have a benchmark that is better suited to your needs. You can now build ETFs, index funds as well as option trading strategies around a benchmark that is a better representation of the entire financial industry than Nifty Bank.

- Performance

So far, the FINNIFTY index has performed very well. With more diversified exposure to different sectors of the Indian economy, it provides more opportunities to investors.

Since its inception, the index has shown returns of 17.54% p.a. compared to the roughly 11% p.a. return of Nifty 50 and 18.85% p.a. returns of the Nifty Bank index.

Conclusion

For any investor, the key thing to remember is portfolio diversification and thorough research on every investment scheme and index in the market. If the above content helped you become more knowledgeable about the stock market, follow the Angel One blog and knowledge centre articles to stay ahead of other investors/traders. If you do not have a Demat account already, open a Demat account with Angel One, India’s trusted broker!