There are multiple ways to measure the size of a company. One is the free-float market capitalization, and the other is the total market capitalization method. Indian bourses use the free-float market capitalization method to arrive at the value of the index. But really how much difference does this method make in valuing the size of a company? Let’s see.

What is market capitalization?

The market capitalization or market cap of a company is its outstanding number of shares multiplied by the price of each stock. So if company A has 50,000 outstanding shares and each share is priced at Rs. 50, then the company’s market capitalization stands at Rs. 25 lakh. Based on the size of the market cap, companies are categorised as either large-cap, mid-cap, or small-cap.

What is Free float market capitalisation?

While calculating the total market capitalization of a company, all the shares, including the ones publicly traded as well as ones held by promoters, government, or other private parties, are multiplied with the stock price. But in the free-float market capitalization, we exclude shares held by private parties like promoters, trusts, or the government. We only consider shares held and traded by the public and multiply them with share price to arrive at a free-float market capitalization of a company.

Let us understand it with an example.

Suppose company B has 60,000 shares trading in public and 40,000 are held by the promoters and family. Face value of each stock is Rs. 50. Now the total market cap would be Rs.50 lakh. But the free-float market cap of the company is Rs.30 lakh. The difference between the total market cap and free-float market cap would be more pronounced in the case of companies with large government holding.

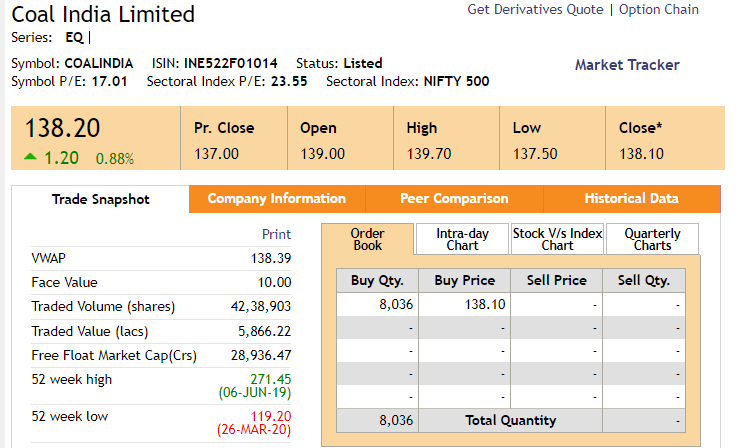

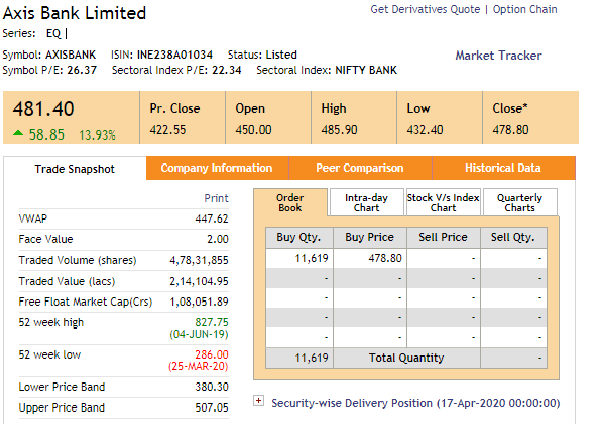

For example, Coal India has a free-float market cap of Rs. 31,168 crore, much lower than its total market cap of Rs. 91,608.96 crore because of a considerably large government holding. In another real-life example, the total market cap of Axis Bank Ltd is Rs. 1.3 lakh crore and the free-float market cap is Rs. 1.08 lakh crore, as of April 17, 2020.

Between two companies, the one with a relatively smaller free-float size will have higher volatility simply because it takes fewer traders to drive change in prices when the free float size is small. But in companies with a larger free-float size, more people are trading the shares, and so it takes more trading volume to make prices change significantly, and so the volatility is low.

Implications of the Free Float Market Capitalisation

In one of its most important applications, Indian bourses National Stock Exchange and Bombay Stock Exchange use the free-float market capitalization to calculate index value. This value is the sum of the free-float market cap sizes of all its listed entities. In other words, a company that has a larger free-float component will also have a larger market weight in the index.

Conclusion:

Stock exchanges worldwide use the free-float market cap method to value indices to eliminate the impact of shares locked up in the hands of promoters or government from reflecting in the market trends in terms of pricing and weightage in the benchmark indices.