Automated Trading is not a new concept in the Indian markets and certainly a much older concept globally. In the United States, Automated Trading accounts for around 85% of the Total Market Volume as per this report. Mind-Blowing number, right? For the Indian markets, this number is hovering around 50% as per this Financial Express Article.

But in India, things have just started picking up in the Automated Trading domain. The adoption is becoming widespread within the retail investor's community because of the better technologies provided by their brokers. Previously, large-scale tech infrastructures and specialised personnel were accessible only to institutional investors, posing challenges for retail investors. At Angel One, we have been working hard behind the scenes to remove all barriers to get into Automated Trading from a technical and financial perspective for a normal retail investor. This led to the launch of SmartAPI.

Isn't that awesome?

What are the features of SmartAPI?

-

It is completely FREE OF COST. You'll be delighted to know that we prioritize the adoption of automated trading for our customers, which is why we have removed all financial barriers. Our goal is to make it easy for you to get started without any charges.

-

We have a dedicated active SmartAPI Forum to answer all your queries promptly by the community and the Angel One team.

-

We have an in-house team of stellar developers, project managers, and technical SMEs who are working hard to make the API more robust and bring more services to your disposal.

-

To reduce language barriers, we have SDKs (Software Development Kits) in different languages like Python, Java, NodeJS, R, Go, C#, .Net, PHP.

-

We give you Historical Data for backtesting purposes, again completely FREE OF COST.

Which Different APIs are offered under SmartAPI.

-

Market Feeds API: This API can be used to access real-time price data for various financial instruments. A couple of use cases of Market Feeds API can be:

-

Fetch the live streaming data and showcase it on your web apps/mobile apps.

-

Create Telegram/Discord alerts to a group of users based on a particular strategy (e.g., when Current Volume > Average Volume)

-

Save the Live streaming data onto your system for quantitative analysis later on.

-

-

Historical Data API: This API can be used to access historical data for the NSE Equity & NFO Futures segment. We are evaluating options to provide NFO options segment data as well. The historical data can be used in multiple ways

- To do quantitative analysis and finding patterns in the stock markets.

- To do backtesting of your strategies to see how they performed in earlier periods of markets.

- To execute strategies that are dependent on historical data.

-

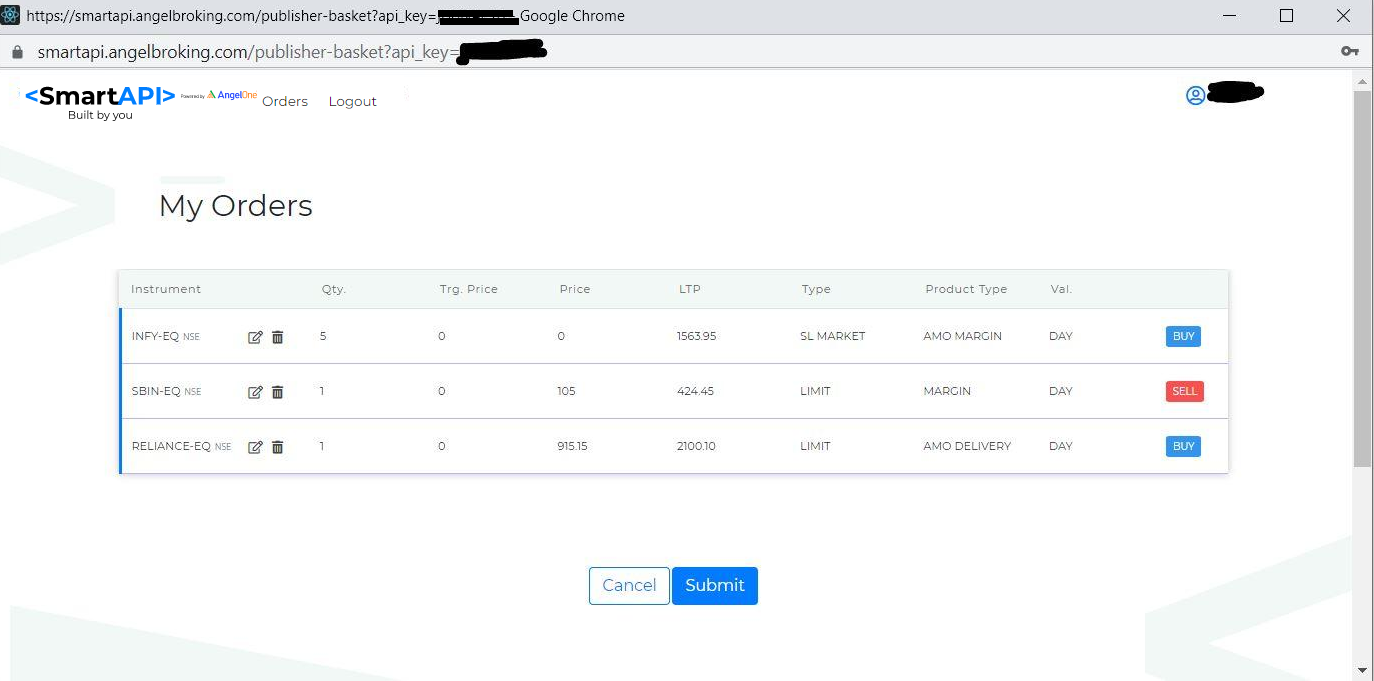

Publisher API: This API allows you to embed buttons on your own websites and apps for users to log in and execute trades with a click of a button. The Publisher API comes in handy if you are a stock advisory firm that wants to give its clients a single click execution button. The Publisher API allows your clients to buy/sell a full basket of stocks in one single click at live prices, see the example screenshot below where your customer just needs to click on Submit, and all trades will be executed.

- Trading API: This API combines Market Feeds AP, Historical Data API, Publisher API and allows you to place orders in your Angel One trading account as well as fetch positions and holdings to monitor your open trades. One single API key created under this category can be used to do all functions, whereas the keys created under other categories will be limited to that respective task. The Trading APIs can be used in various ways:

-

To place order into your account based on your own trading strategy.

-

To fetch holdings, margins, fund balances, positions of intraday trades.

-

Faster execution of trades, APIs allow you to execute 10 trades per second, faster than any human can do manually.

-

So by now, you must have realized that our SmartAPI is packed with tons of features and will suit any use case that you might have. We are committed to making more improvements and enhancements in the API service, and we value all user feedback. If you feel we have some features lacking, please feel free to submit your feedback to the SmartAPI Forum.

At Angel One, we value knowledge and commitment; in the coming weeks, we will be publishing around 8-10 beginner series blogs showing how you can use the SmartAPI to create multiple trading automations/products and enhance your trading journey. So if you would like us to cover any specific topic, please let us know below in responses.

Disclaimer: "Investments in securities market are subject to market risk, read all the related documents carefully before investing."