Angel One offers you seamless transactions while trading online. With our app, you can access the stock market from anywhere, customise your watchlist, modify your orders, monitor your portfolio, gain information about the companies, and trade in multiple exchanges.

Under the new Angel One Super App, adding funds is even easier with digital modes of payment available on our platform. Digital funds transfer process is gaining importance these days because of -

- Faster payment

- 24*7 transfer facility available

- Higher security

- Ease of carrying out transactions

- Tracks & maintains a record of each transaction

Steps to Add Funds

Here’s a quick step-by-step process of adding funds to your Angel One account -

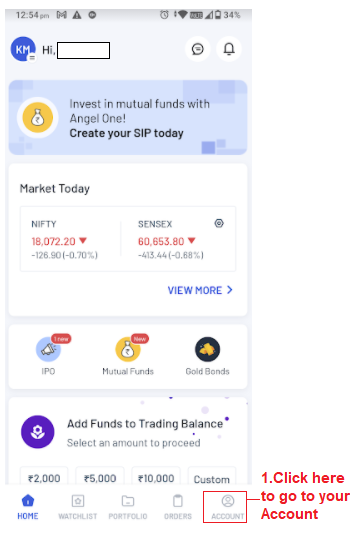

- Go to the ‘Account’ section after logging in

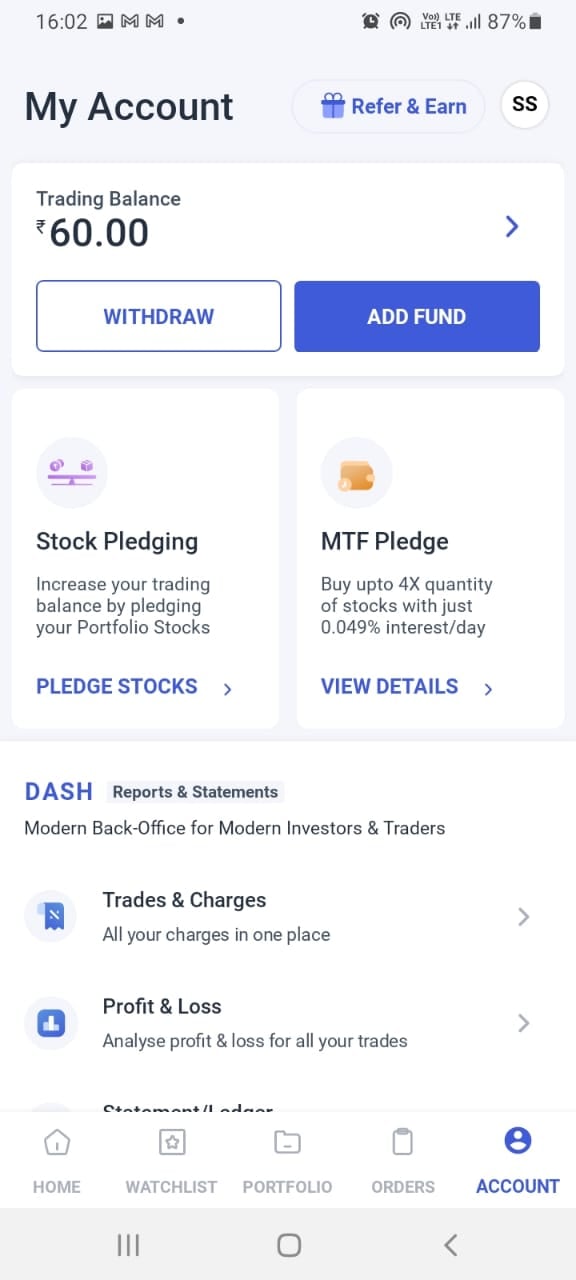

2. Click the ‘Add funds’ button

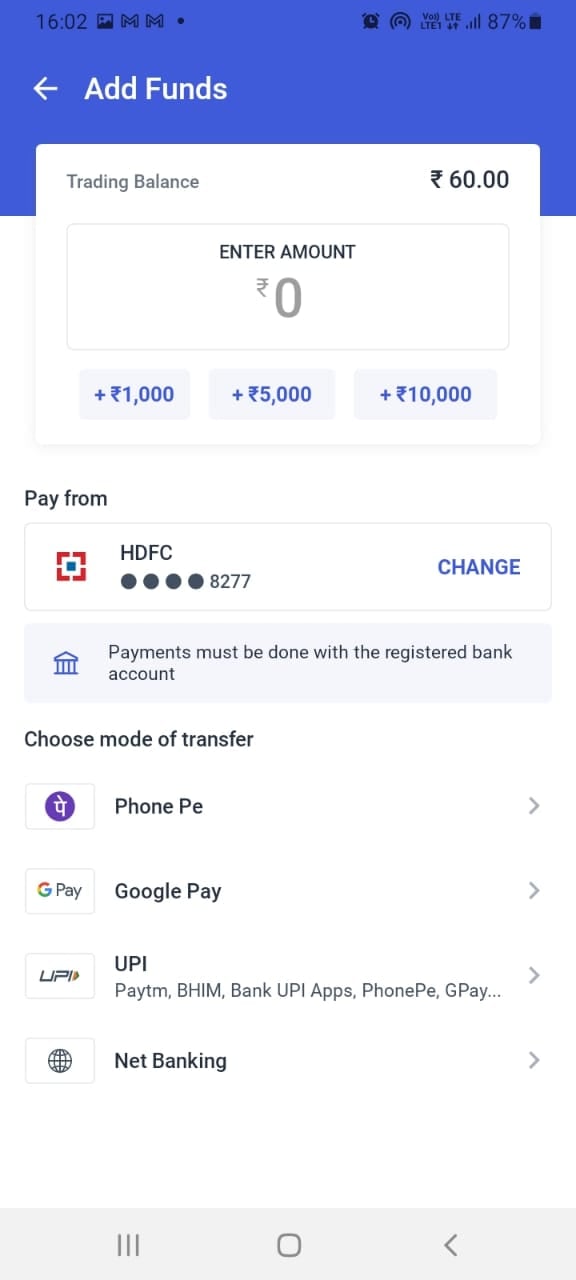

3. Enter the amount that you want to add

4. Choose the bank account that you want to add the funds from - kindly note that only the bank accounts registered with Angel One (which you select here on the Add Funds page) should be used further as well in the transaction completion. You may click on the “Change” button next to the bank account in case you have multiple accounts and wish to perform the transaction with some other bank account.

5. Choose the mode of transfer - i.e. Net Banking or UPI (if you have the Google Pay or PhonePe app on your device then you can add funds directly through those apps themselves by clicking on the options seen in the screenshot above).

Payments Gateways

Angel One offers you two digital payment modes to transfer funds via our app/platform:

- UPI transfer

- Net banking

The below table gives detailed information about these two payment modes for you to make an informed decision.

Angel One offers you two digital payment modes to transfer funds via our app/platform: UPI transfer & net banking. The below table gives detailed information about these two payment modes for you to make an informed decision.

| Particulars | UPI Transfer | Net Banking |

| Details Required | Valid UPI ID approved by NPCI | Login credentials |

| Limit Updation in Angel One Account | Instant | Instant |

| Transfer Limit | Up to ₹2 lakh (₹5000 for 1st transaction) | Depends on TPT (Third Party Transfer) limit in your bank account Lower limit of ₹50 |

| Charges | Angel One doesn’t charge any fees to add funds to your account | |

UPI transactions can be conducted through any digital payment apps such as Google Pay, Paytm, BHIM and PhonePe.

Note: As per SEBI regulations, the account from which funds can be added must be registered with the depository participant (Angel One in this case).

If you are using net banking for your transactions, then you can use bank accounts from a limited number of banks. The list of banks whose accounts may be used for netbanking can be found below -

List of Banks through which user can perform Net Banking transactions -

| Sr. No. | Bank Name |

| 1 | Allahabad Bank |

| 2 | Andhra Bank |

| 3 | AU Small Finance Bank |

| 4 | Axis Bank |

| 5 | Bandhan Bank |

| 6 | Bank Of Baroda |

| 7 | Bank of India |

| 8 | Bank of Maharashtra |

| 9 | Canara Bank |

| 10 | Capital Bank |

| 11 | catholic syrian bank |

| 12 | Central Bank of India |

| 13 | City Union Bank |

| 14 | Corporation Bank |

| 15 | DCB |

| 16 | Deutsche Bank |

| 17 | Dhanalaxmi Bank |

| 18 | Equitas Small Finance Bank |

| 19 | Federal Bank |

| 20 | Gujarat State Cooperative Bank |

| 21 | HDFC Bank |

| 22 | HSBC |

| 23 | ICICI Bank |

| 24 | IDBI Bank |

| 25 | IDFC Bank |

| 26 | Indian Bank |

| 27 | Indian Overseas Bank |

| 28 | Indusind Bank |

| 29 | Jammu & Kashmir Bank |

| 30 | Karnataka Bank |

| 31 | Karur Vysya Bank |

| 32 | Kotak Mahindra Bank |

| 33 | Lakshmi Vilas Bank |

| 34 | Punjab National Bank |

| 35 | Saraswat Bank |

| 36 | South Indian Bank |

| 37 | Standard Chartered |

| 38 | State Bank of India |

| 39 | Surat Bank |

| 40 | Sutex Bank |

| 41 | SVC Co-operative Bank |

| 42 | Tamilnad Mercantile Bank |

| 43 | The Ratnakar Bank Limited (RBL) |

| 44 | UCO Bank |

| 45 | Union Bank of India |

| 46 | Utkarsh Bank |

| 47 | Yes Bank |

However, if you are using UPI (including via Google Pay or PhonePe) then you may transact using accounts from any bank (as long as it is registered with your Angel one account).

If your device already has the GPay or PhonePe app downloaded, then Angel one will directly show them as payment options to the user.

Payment limits

For UPI, there is no minimum transaction limit, while the maximum amount that you can pay through UPI is ₹ 2 lakh (this also depends on the bank with which you have the account).

For Net banking, the minimum amount that you can transfer in a single transaction is ₹50.

Further steps to be taken as per the mode of transaction have been explained in the following section -

Net Banking Transfer Process -

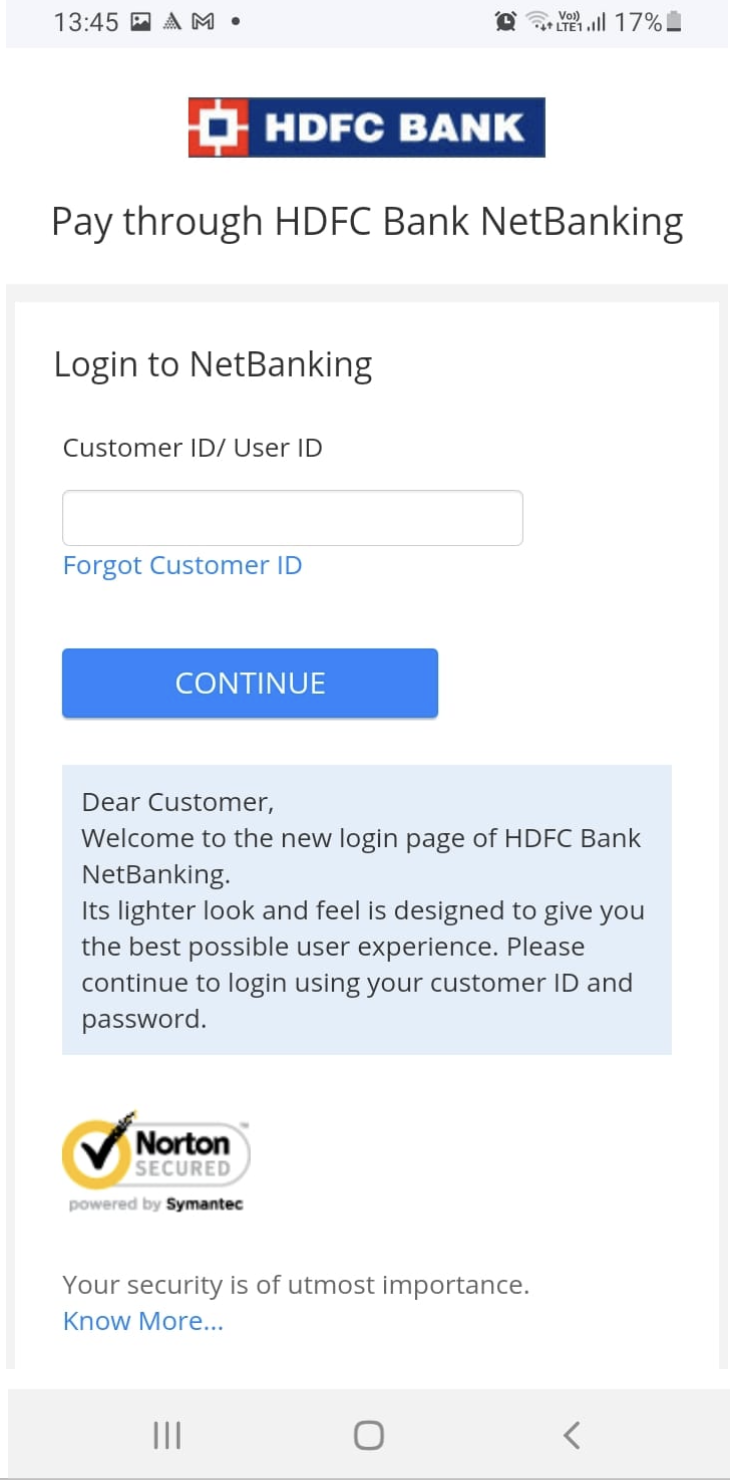

- After selecting the mode of transfer as Net banking on the Add funds page, the user will be redirected to the page of the bank whose account he has selected on the Add Funds page.

2. On this page, enter the required details e.g. customer ID and password.

3. Once the transaction is completed, the user will be redirected to the Angel One app page with respective status of transaction (i.e. either success, failed or pending).

UPI Transfer Process -

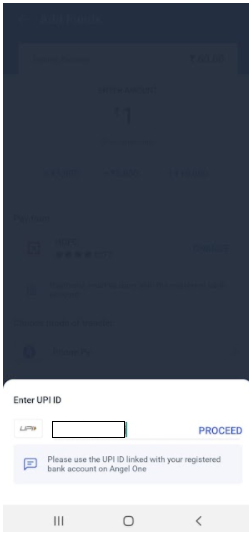

1. After selecting the mode of transfer as UPI on the Add Funds page, the user will be asked to enter the UPI ID/ VPA.

2. Enter the UPI ID/ VPA of any UPI application.

3. Click on Proceed.

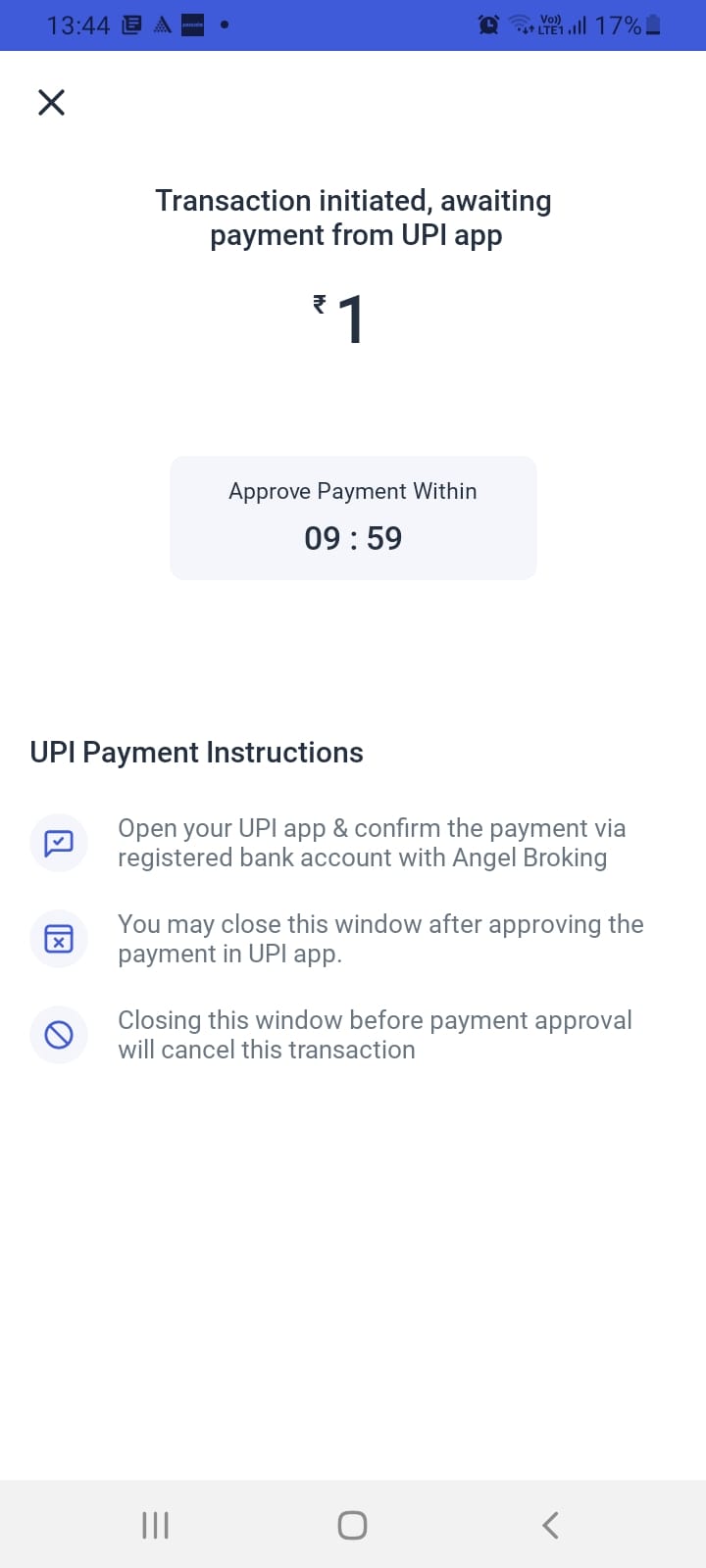

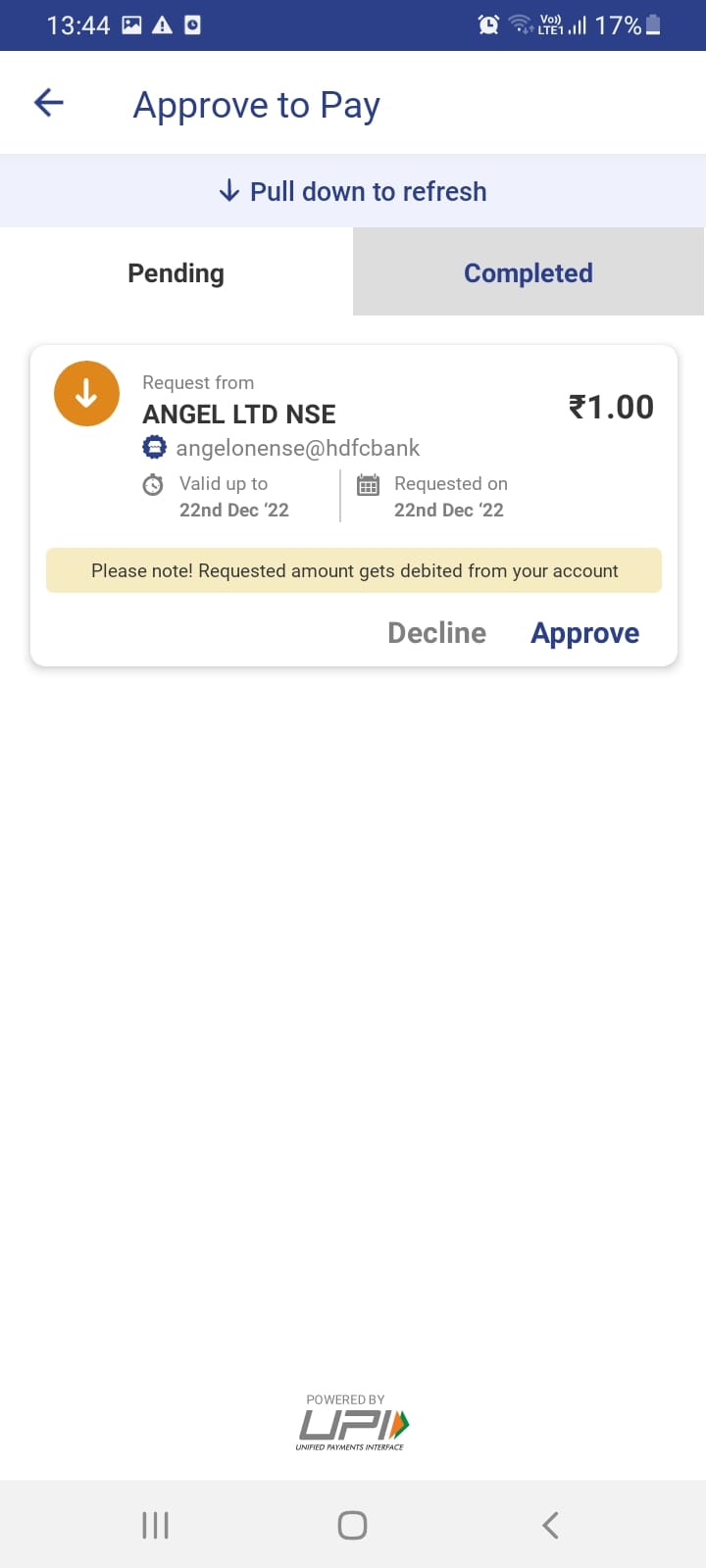

4. Go to the respective UPI application, the UPI ID/VPA of which you had entered.

5. You will find a payment request from Angel One in the UPI application.

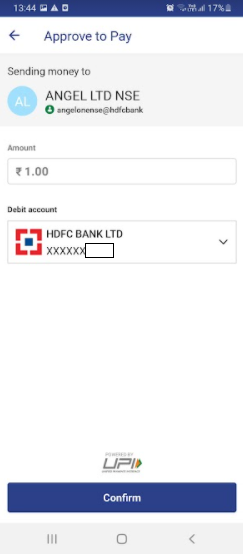

6. Click on Approve to complete the transaction.

7. Enter the UPI PIN to authorise the transaction.

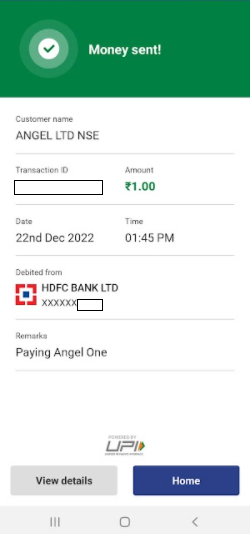

8. Once the transaction is completed, the user will be redirected to the Angel One App page with respective status of transaction (i.e. either success, failed or pending).

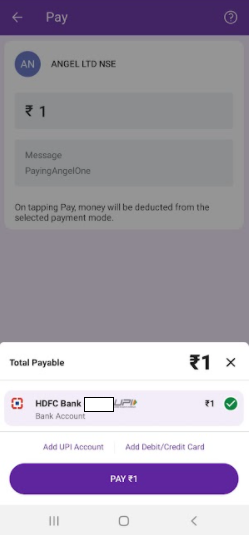

GPay or PhonePe Transfer Process -

- After selecting the mode of transfer as Gpay/Phonepe on the Add Funds page, the user will be redirected to the respective UPI Application directly.

2. In case of multiple accounts registered in Gpay/Phonepe, please select the account which you have registered in Angel One, to complete the transaction correctly.

3. Enter the UPI PIN to authorise the transaction.

4. Once you complete the transaction, you will be redirected to the Angel One App page where you can check the status of transaction (i.e. either success, failed or pending).

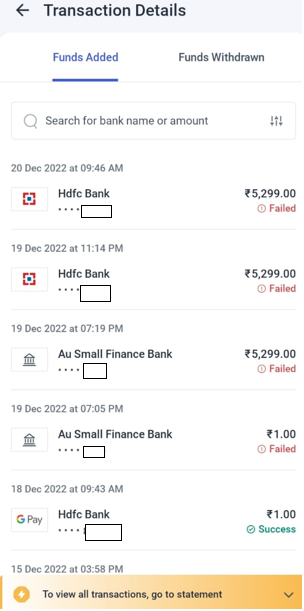

You can check the status of your transaction under the “View Funds Transaction Details'' in the Account section of the app. There are two sections under this - funds added and funds withdrawn, both of which can be tracked separately through this subsection. We will learn more of this from the later section on View Funds Transaction Details.

How to check if the transaction is reflected on the funds in your account?

Once a transaction is executed, you may check whether the transaction is reflected in your balance. For that, you must go to your Account and check your Trading Balance or click “View Funds Transaction Details”. If you find that the balance is not updated, then try switching to another section (such as Home or Watchlist) and then come back again to Account. The balance should be updated by then.

View Funds Transaction Details

Under this section you can view two sections - funds added and funds withdrawn.

Funds Added

Under this section you can check all the fund additions made by you along with the following information -

- Date and time of the transaction

- The bank a/c from which the transaction was made

- The amount involved

- The status of the transaction - e.g. Pending

If you are concerned about transactions related to a particular bank or even a particular amount, then you can directly search for the transaction by entering the bank name or the amount in the search bar.

Final Words

Let us all get rid of the unnecessary stress that we experience and apprehensions we have whenever making online transactions. Choose a reliable partner like Angel One for your trading and investing needs. Open Demat account with Angel One, today!